ABOUT M-JIAJIRI

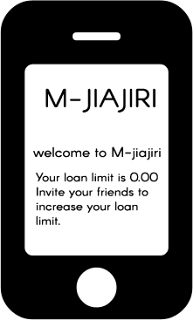

Its a mobile financial solutions project still in beta that is aiming at creating a Kenyan youths community or sacco that is enjoying nil interest rate business loans to startup their business.M-jiajiri is accessible over a mobile phone platform after successful registration. It's offices are located in Nairobi.

|

| M-jiajiri message |

CONTACTS.

Our Address

Loresho Ridge Road,

Loresho Shopping Centre,

Office Suite,

Loresho Shopping Centre,

Office Suite,

By Phone

+254 728 494 345

TERMS AND CONDITIONS

1. Registration fee of Ksh.200 is paid at registration and is non-refundable.

2. All transactions are done through mobile phones and no cash changes hands.

3. The telephone number is not to be used more than once at registration so that no one registers with more than Kshs.200.

4. Fraudulent transactions are to be avoided at all cost and all mobile phone holders must be registered.

5. At no point in time is money lent out to the borrower until the previous loan is paid up.

6. Commissions of 20% is calculated on every registration and is paid out on request.

2. All transactions are done through mobile phones and no cash changes hands.

3. The telephone number is not to be used more than once at registration so that no one registers with more than Kshs.200.

4. Fraudulent transactions are to be avoided at all cost and all mobile phone holders must be registered.

5. At no point in time is money lent out to the borrower until the previous loan is paid up.

6. Commissions of 20% is calculated on every registration and is paid out on request.

7. The borrower will meet all costs relating to loan disbursement

HOW DOES ONE JOIN M-JIAJIRI

Existing Safaricom customers /New customers will have to register for M-pesa First. This service is currently available to safaricom subscribers only.- On your phone dial *384*126#

- Register by choosing ‘yes’.

- Accept terms and conditions.

- Pay the fee of kes 200 via paybill number 885200.

- You will receive a commission of kes 40 plus a short message and a reference number.

- ‘Invite friends’ as many as possible and earn commissions.

- You will receive commission on every person you invited.

APPLYING FOR THE LOAN

After successful registration,a member must continue to invite friends to join.That way the member will be accumulating commissions and more importantly rising the loan limit.The loan limit is dependent of the number of friends invited.Just over your mobile phone, you'll apply for the loan and start your business right away.

UNIQUENESS OF THE PRODUCT.

- The members themselves do the recruitments as opposed to the normal working in companies which employ Marketing executives to perform the same duties;

- The product is cost effective as it engages a larger number of self employed personnel earning commissions compared to few marketing executives earning huge salaries with less work inputs;

- The product is able to identify and calculate commissions as well as loans to each individual based on referral reference numbers;

- The product recruits, employs and provides financial assistance to registered members;

- Unlike other lending institutions, loans are given at nil interest rate and no security is held as collateral;

DISCLAIMER; Loans Kenya is not affiliated to M-jiajiri.Join at your own consent.